October 2025 marked another milestone in Tokyo’s property market as new condominium prices reached the second-highest level ever recorded. The average price of a new condominium in central Tokyo’s 23 wards climbed to ¥153.13 million yen, marking an 18.3% increase from the same period last year. This figure comes second only to March 2023, when prices briefly exceeded 200 million yen.

Strong Luxury Market Drives Price Growth

The surge in central Tokyo prices reflects ongoing demand for high-end properties in prime locations. Ultra-luxury properties drove much of the growth, supported by rising land values throughout the capital. Minato Ward, one of Tokyo’s most sought-after residential areas, saw particularly strong performance with average unit prices reaching ¥640.05 million yen according to the Real Estate Economic Institute’s data.

This upward trend isn’t isolated to central Tokyo. Across the greater metropolitan area, which includes Tokyo and the three surrounding prefectures of Kanagawa, Saitama, and Chiba, average prices rose 7.1% year-on-year to ¥98.95 million yen. This marks the sixth consecutive month of price increases for the broader region.

Regional Price Variations Show Mixed Results

While central Tokyo and some neighboring areas saw gains, the picture varied across different parts of the metropolitan region. In western Tokyo, outside the 23 wards, prices increased 3.0% to ¥66.37 million yen, while Saitama Prefecture recorded a 6.9% rise to ¥61.56 million yen.

However, not all areas experienced growth. Kanagawa Prefecture saw slight prices fall, and Chiba Prefecture recorded more of a decline. These regional differences reflect varying levels of demand and development activity across the metropolitan area.

Supply Constraints Continue

The number of new condominiums listed for sale in Tokyo and neighboring prefectures fell 28.2% to 1,316 units in October, marking the first decline since June 2025. This continued shortage of new units has contributed to sustained upward pressure on prices, particularly in areas where demand remains strong.

The limited supply situation isn’t new. Tokyo’s condominium market has faced inventory constraints for several years, with developers grappling with high construction costs and land prices. When fewer properties come to market, competition among buyers intensifies, which tends to push prices higher.

Tokyo Luxury Villas: Housing Japan is introducing an exclusive collection of architecturally designed villas across Tokyo’s distinguished suburbs. Crafted with attention to detail and premium materials, these residences offer a rare opportunity for those seeking exceptional properties. High-net-worth individuals interested in learning more about these homes are invited to register their interest.

What This Could Mean for the Market

The October data reinforces several trends that have shaped Tokyo’s property market in recent years. High-end developments continue to find buyers despite elevated price levels. Areas with good transport links, established amenities, and proximity to business districts remain particularly attractive to both domestic and international buyers.

For those considering property purchases in Tokyo, these price levels represent a significant commitment. However, the data also shows that not all areas are experiencing the same rate of growth. Buyers looking beyond the most central locations may find more moderate price points, particularly in Chiba and parts of Kanagawa Prefecture.

The rental market has also felt the effects of these price increases, with rental properties in central Tokyo seeing increased demand and rising rents in some areas.

Looking Forward

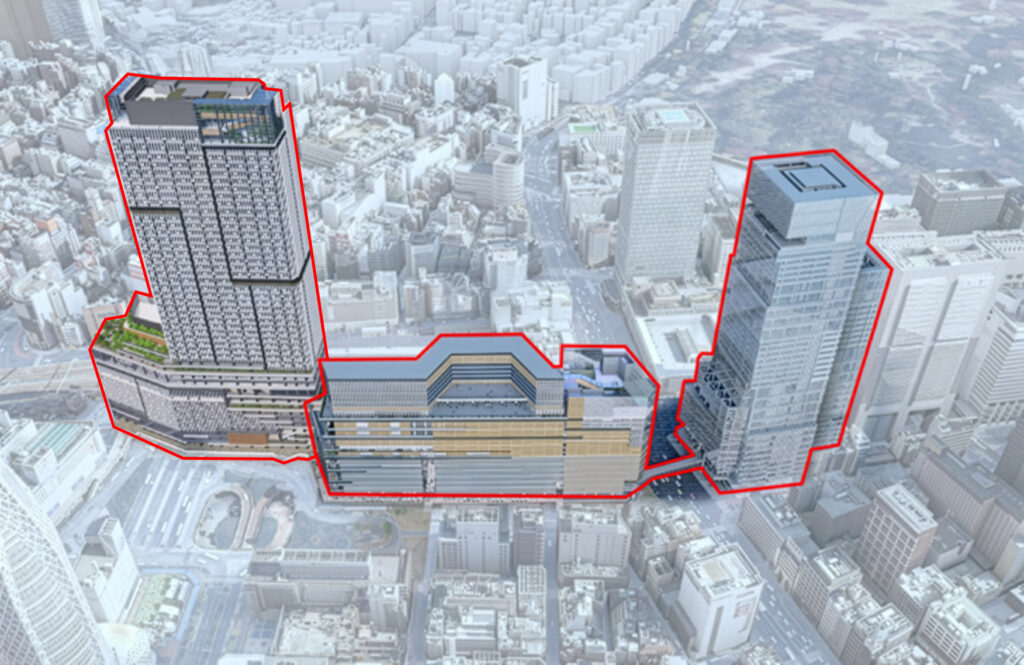

As Tokyo continues to develop, with major infrastructure projects and urban renewal initiatives ongoing, the property market will likely remain active. The upcoming completion of developments like the Tsukiji, Hamamatsucho Redevelopments and other large-scale projects in the coming years may add to the supply of premium residential units, as well as effect demand due to the amenities and attractions they create

For now, October’s figures confirm that Tokyo’s property market, particularly at the higher end, maintains its momentum. Whether this trend continues will depend on various factors including economic conditions, interest rates, and the pace of new development across the city.

Quick Facts

Average Prices by Area (October 2025):

- Tokyo 23 Wards: 153.13 million yen (up 18.3%)

- Greater Tokyo Metropolitan Area: 98.95 million yen (up 7.1%)

- Western Tokyo: 66.37 million yen (up 3.0%)

- Saitama Prefecture: 61.56 million yen (up 6.9%)

Market Activity:

- New units listed: 1,316 (down 28.2% year-on-year)

- Consecutive months of price growth (Greater Tokyo): 6 months

All numeric data sourced from the Real Estate Economic Institute (JP only)

Housing Japan: With 25 years of experience in Tokyo’s property market, Housing Japan specializes in buying, selling, and managing residential and investment luxury real estate in central Tokyo. Our team of multilingual realtors guides both local and international clients through every step of the process, providing personalized service and expert market insights. From property search and negotiation to closing and comprehensive management services, we offer one-stop support to help you navigate Tokyo’s dynamic real estate landscape with confidence.