Japan offers investors two very different paths to build wealth: buying physical property or investing in digital currencies like Bitcoin. Both have supporters, but which one actually makes more sense for building long-term wealth in Japan? This guide breaks down the real benefits and challenges of each option to help you make an informed decision.

What Japanese Real Estate Investment Means

Real estate investment in Japan means buying physical property like apartments, houses, or commercial buildings. When you own real estate, you have something tangible that serves a basic human need. Everyone requires a place to live or work, which helps keep real estate valuable over time.

How Real Estate Works in Japan

Japan offers several factors that make property investment attractive. The country has limited land available, especially in Tokyo and other major cities. This scarcity helps support property values. Additionally, Japan’s changing population creates specific housing needs that informed investors can address.

Japan’s legal system makes property investment accessible for foreign buyers. Unlike many countries that limit foreign ownership, Japan allows people from other countries to buy property with the same rights as Japanese citizens. The purchase process follows established procedures with clear legal protections for owners.

While foreign investors can legally buy property without restrictions, having expert local knowledge significantly improves investment results. Working with experienced real estate professionals who understand Tokyo’s luxury market, local regulations, and investment opportunities, like the team at Housing Japan, helps investors navigate the market and identify properties that match their goals.

Understanding Cryptocurrency Investment

Cryptocurrency is digital money that exists only online. Popular options in Japan include Bitcoin, Ethereum, and Japanese-created coins like MonaCoin (MONA) and NEM (XEM). Crypto prices can rise quickly, but they can also drop just as fast.

Japan’s Cryptocurrency Environment

Japan was among the first countries to create proper cryptocurrency regulations. This provides more security than some other places, but it also means more rules and taxes. The Japanese government classifies crypto as miscellaneous income, which creates complicated and potentially expensive tax situations.

Bitcoin reached prices above $100,000 in 2024 and climbed as high as $123,000 in mid-2025, showing the potential for significant gains. However, prices also fell by over 30% during periods of economic uncertainty and geopolitical tension in early 2025. Bitcoin’s recent 30% pullback from its all-time high pushed its one-month volatility measure to nearly 70, compared to an average of about 50, demonstrating the dramatic price swings that characterize cryptocurrency markets.

Comparing How Investments Perform

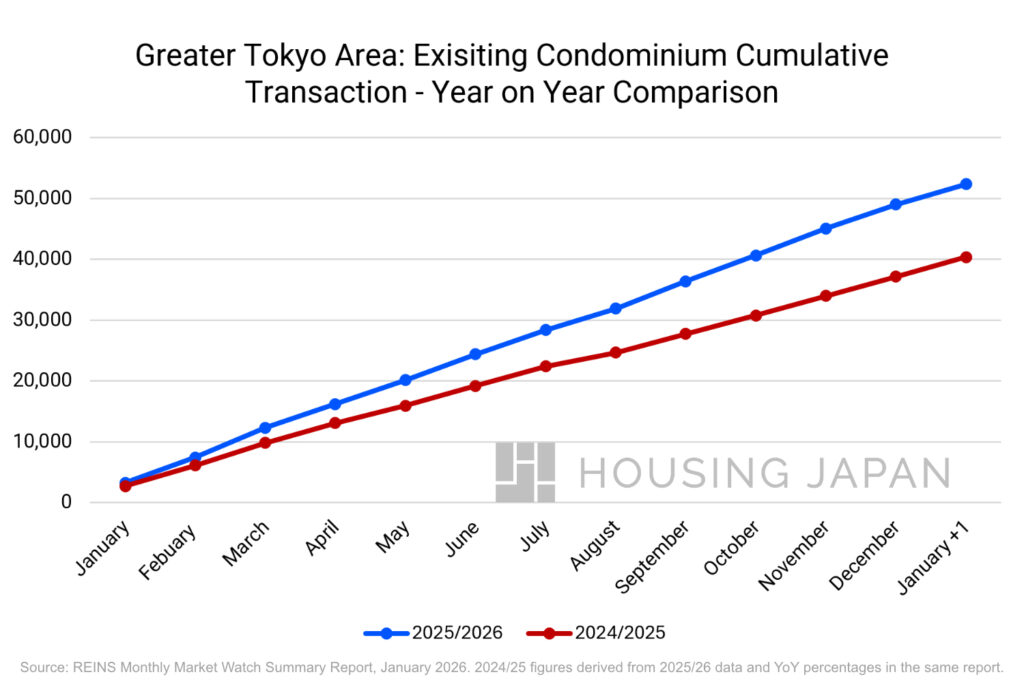

Real Estate Performance in Tokyo

Tokyo real estate has historically grown by 3-6% per year in good locations. This might seem slow compared to cryptocurrency’s dramatic moves, but it provides steady progress. Additionally, rental income delivers monthly cash flow that investors can count on. Properties in Tokyo’s prime areas have shown strong performance in recent years.

Cryptocurrency Returns and Risks

Cryptocurrency can produce dramatic gains, but it carries equally dramatic risks. Bitcoin’s price movements have been marked with sharp volatility in both directions during its current cycle. Some people lose money in crypto because they buy when prices are high and sell in panic when prices drop. The constant price swings create stress and can lead to poor decision-making.

Tax Treatment: A Major Difference

Real Estate Tax Benefits in Japan

Japan offers several tax advantages for real estate investors. You can deduct maintenance costs, property management fees, and depreciation from your taxable income. When you sell property, capital gains taxes are lower if you hold it for over five years. These tax benefits help improve your actual returns.

Cryptocurrency Tax Burden

Japan taxes crypto gains as miscellaneous income, which means rates up to 55% for high earners. Every trade counts as a taxable event, creating complex record-keeping requirements. There’s no long-term capital gains benefit like with real estate. This tax treatment significantly reduces the actual profit many cryptocurrency investors can keep.

Risk and Stability Considerations

What Real Estate Provides

Property gives you something physical. Even if prices drop temporarily, you still own land and buildings. People always need places to live, so demand continues. Japanese building standards are strong, protecting your investment from earthquakes and other disasters. This physical security provides peace of mind that digital assets cannot match.

Cryptocurrency Volatility Challenges

Crypto prices can swing wildly based on social media posts, government announcements, or technical problems. Many cryptocurrencies have lost 90% or more of their value and never recovered. There’s also risk of losing access to your digital wallet or facing problems if cryptocurrency exchanges go out of business.

Practical Investment Factors

Getting Started with Real Estate

Buying property in Japan requires more upfront money and paperwork, but the process follows established procedures. You need to understand local markets, property conditions, and rental management. This takes time but creates valuable knowledge. Working with a knowledgeable real estate company such as Housing Japan can make the process much easier for international investors.

Cryptocurrency Investment Simplicity

You can buy cryptocurrency in minutes through Japanese exchanges like Bitflyer or Coincheck. However, this simplicity can be dangerous. It’s easy to invest money you can’t afford to lose without proper research or understanding of the risks involved.

Market Timing Considerations

Real Estate Market Cycles

Japanese real estate moves in longer cycles. While there are ups and downs, changes usually happen over months or years, giving you time to make thoughtful decisions. Current interest rate conditions affect borrowing costs for property purchases.

Cryptocurrency Market Unpredictability

Bitcoin’s 2025 performance was marked by remarkable volatility, with prices reaching unprecedented highs near $130,000, only to experience pronounced pullbacks driven by macroeconomic uncertainties and regulatory announcements. Cryptocurrency markets never close and can change dramatically overnight. This constant volatility makes timing nearly impossible. Many investors check prices frequently, creating stress and often leading to poor decisions. There’s also the risk of losing access to your digital wallet due to government law changes, crypto exchanges and wallet providers going defunct such as FTX in 2022.

Income Generation Potential

Rental Income Benefits

Real estate produces monthly rental income that can cover loan payments and provide profit. Some Tokyo properties can yield 3-6% annually in rent alone, before any price appreciation. This income provides stability during market downturns and helps cover ownership costs.

Limited Cryptocurrency Income

Most cryptocurrencies don’t produce income unless you stake them or lend them out, which adds more risk. You’re betting entirely on price increases rather than getting paid while you wait. This means no cash flow to support you during price drops.

Long-Term Wealth Building

Real Estate as a Foundation

Property has built wealth for centuries. In Japan, families often pass real estate down through generations. The combination of rental income and gradual appreciation creates lasting financial security. Real estate also provides a natural hedge against inflation.

Cryptocurrency’s Uncertain Future

Cryptocurrency is still very new, and while some digital currencies might become important long-term, many will likely disappear. Building a retirement plan around crypto requires betting that your chosen currencies will survive and thrive for decades. The technology and market are too new to have proven long-term track records.

Working with Real Estate Professionals

Working with experienced real estate professionals makes a significant difference in investment success. Housing Japan specializes in Tokyo’s luxury real estate market and understands both local regulations and international investor needs. Their team helps identify properties with strong rental potential and appreciation prospects. This expertise can mean the difference between a good investment and a great one. With 25 years of market knowledge, they can guide investors away from common mistakes that cost money. Housing Japan also

Making the Right Choice for Your Situation

Consider Real Estate If You:

- Want steady, predictable returns over time

- Prefer physical assets you can see and touch

- Need monthly income from your investment

- Plan to invest for five years or more

- Can handle or arrange property management

Consider Cryptocurrency If You:

- Can afford to lose your entire investment

- Enjoy high-risk scenarios with potential for dramatic gains

- Have extra money beyond your main investment plan

- Understand technology and market analysis well

- Can handle watching significant price swings without panic

Building Real Wealth in Japan

While cryptocurrency might grab headlines with dramatic price moves, Japanese real estate offers a proven path to building lasting wealth. The combination of steady appreciation, rental income, tax benefits, and physical security makes real estate a sensible choice for most investors looking to build wealth in Japan.

Real estate investing requires more work and knowledge than buying crypto, but that extra effort creates real value and understanding. The time spent learning about markets and properties leads to better decisions and better results over time. In Japan’s stable, regulated market, property investment offers a good balance of growth potential and security.

For investors serious about building wealth in Japan, partnering with experienced professionals like Housing Japan provides the expertise needed to succeed. Their deep market knowledge and investor focus help you avoid costly mistakes while identifying opportunities in Tokyo’s dynamic real estate market.

The choice between real estate and cryptocurrency isn’t just about potential returns. It’s about building a foundation for long-term financial success that matches your goals, risk tolerance, and investment timeline. For most people investing in Japan, real estate provides that foundation better than digital currencies.

Common Questions About Investing in Japan

Is real estate investment in Japan safe for foreigners?

Yes, Japan welcomes foreign real estate investment with clear legal protections. The process is straightforward, and ownership rights are secure. Many international investors successfully own Japanese property.

How much money do you need to start investing in Japanese real estate?

Entry points vary, but quality Tokyo properties often require 20-30% down payments. This typically means starting with several million yen, though financing options can help qualified buyers.

What are the main risks with cryptocurrency in Japan?

High tax rates on gains, extreme price volatility, and regulatory changes pose significant risks. Technical issues like lost passwords or exchange problems can also cause total losses. Bitcoin’s volatility has spiked significantly in 2025, with similar spikes previously occurring during major market stress events.

Can you invest in both real estate and crypto?

Yes, some investors use both as part of a diversified portfolio. However, real estate should form the foundation due to its stability, with crypto representing only a small, high-risk portion if included at all.

Why is Tokyo real estate particularly attractive?

Tokyo combines limited land supply, strong rental demand, good infrastructure, and stable government policies. The city’s global importance and ongoing development projects continue supporting property values.