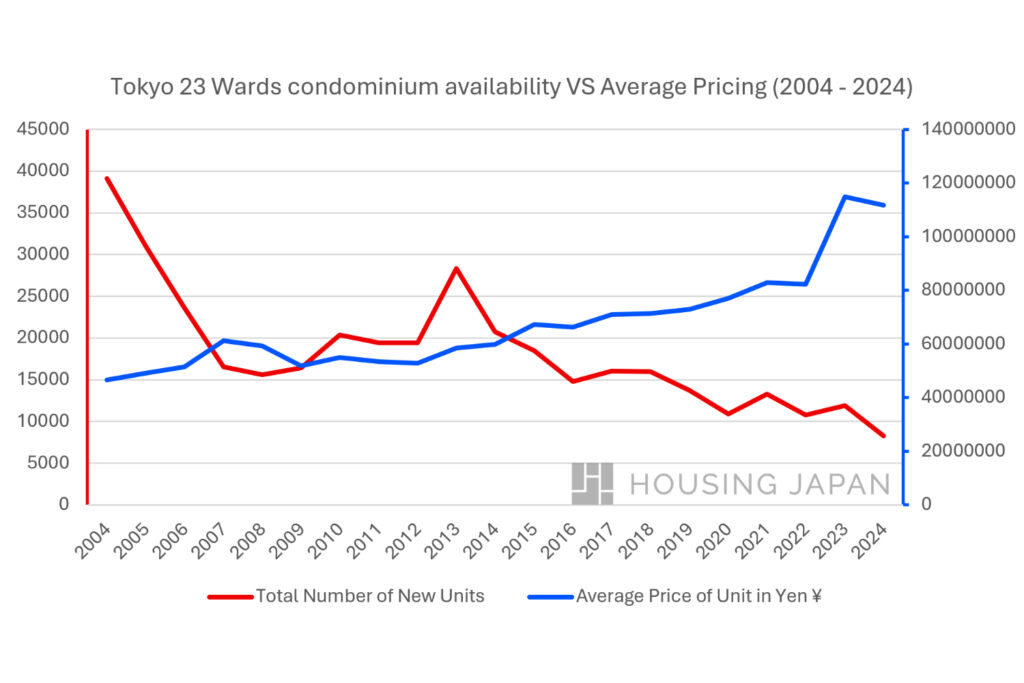

The supply of new condominiums in the Tokyo metropolitan area is heading toward historic lows. According to the Real Estate Economic Institute, only 23,000 new units are forecast for 2026, marking the lowest level in over 50 years. This sharp decline, combined with record-high prices, is pushing many buyers toward the used housing market in what some industry observers are calling a “new construction ice age.”

What Is Causing the Decline in New Condominiums?

The primary factor driving the shortage is intense competition for available land in central Tokyo.

Finding suitable development sites has become increasingly difficult. Condominium developers now compete not just with each other, but also with office, hotel, and mixed-use projects for prime locations. In surveys of major developers, many report that securing land has become more challenging, with competition from other sectors making acquisition more difficult even when offering competitive prices.

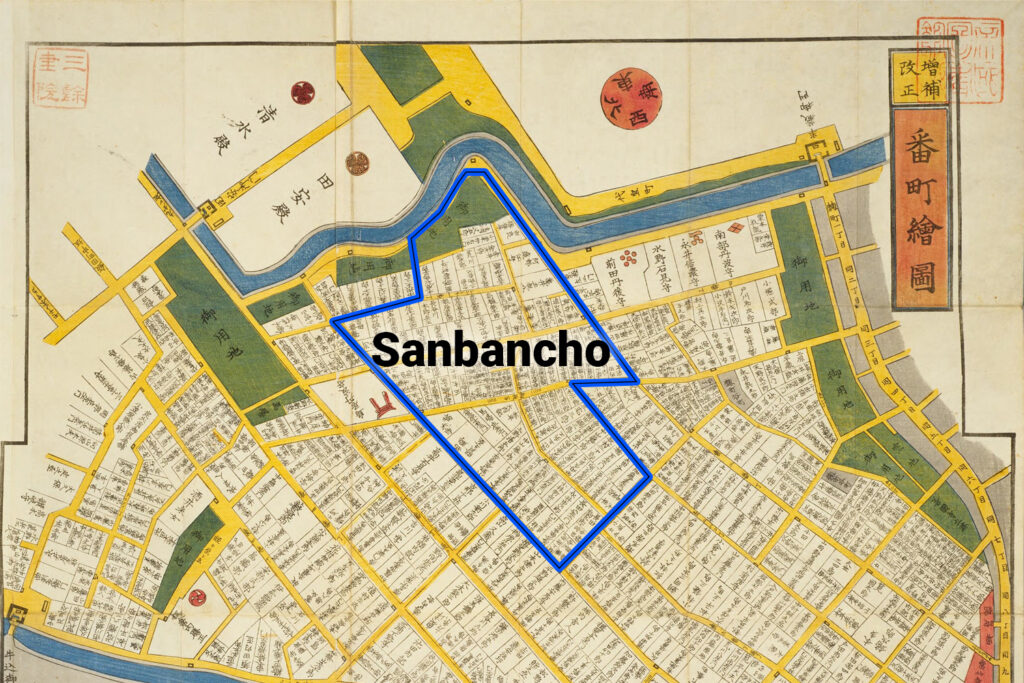

A new segment of land acquisition is emerging, with property developers focused on securing exceptional sites for super high-end luxury villa and residential developments in central Tokyo. These properties have become increasingly popular with high-net-worth individuals. For example, Housing Japan recently developed a House in central Chiyoda in a prime location called Sanbancho House.

This scarcity has contributed to significant price increases. In March 2025, the average price of new condominiums in the greater Tokyo area hit 104.85 million yen (approximately $700,000 USD Jan 2026), representing a 37.5% year-on-year increase. For context, the average price a decade ago was around 67 million yen. In Tokyo’s 23 wards specifically, the average new condominium price now exceeds 116 million yen.

Even households with two high incomes are finding new condominiums increasingly competitive. The combination of limited supply and elevated prices has fundamentally changed how Tokyo residents approach home buying.

How Is the Used Housing Market Responding?

With fewer new options available, demand has shifted significantly to the secondary market. During the first half of 2025, around 24,659 condominium units sold in Greater Tokyo were pre-owned. This is a 27.17% year-on-year increase according to the Land Research Institute.

The market share tells a similar story. New condominiums now represent only about 10% of total condominium transactions in Tokyo, down from over 20% just a few years ago. Used condominiums make up the remaining 90%, a reversal that would have seemed unlikely in previous decades.

Prices in the used market have also risen, reflecting strong demand. Used apartments in Tokyo’s 23 wards recorded a 28.3% year-over-year increase, the highest growth rate since data collection began. In the three central wards, average prices for a 56 square meter used condominium built around 23 years ago now exceed 120 million yen.

Transaction activity has been robust. The number of pre-owned condominium contracts in the Tokyo metropolitan area in March 2025 was 4,991, a significant increase of 31.0% year-on-year and the fifth consecutive month of year-on-year growth.

What Does This Mean for Buyers?

For buyers considering properties in Tokyo, the current market creates both challenges and opportunities.

Used condominiums offer several advantages. Buyers can see exactly what they are purchasing rather than relying on floor plans and model rooms. Many used properties are located in established neighborhoods with mature infrastructure and community amenities.

However, buyers should consider some important factors. Older buildings may have higher maintenance fees as they age. Some may require renovation to meet current standards for earthquake resistance or energy efficiency. The condition of the building management association and long-term repair plans become crucial evaluation criteria. Working with an experienced and well-established Real Estate Agent, Such as Housing Japan, can help you find a Tokyo property right for you.

Government Policy Changes

The Japanese government has recognized this market shift and is adjusting policy accordingly. Recent extensions to the mortgage tax reduction program have expanded benefits for used housing purchases, particularly for properties meeting certain environmental performance standards.

For households with annual incomes of 10 million yen or less, these expanded benefits make used housing even more financially attractive compared to new construction.

Looking Ahead

Industry analysts expect the tight supply of new condominiums to continue through 2026 and beyond. Limited supply of new condominium units continues to push property prices higher for both primary and secondary markets.

The central Tokyo market is becoming increasingly segmented. Prime wards such as Minato, Shibuya, and Chuo continue to see strong demand from both domestic and international buyers, while outer areas show more varied performance. Foreign investment remains significant, with 20% to 40% of new apartments in central wards being purchased by overseas buyers.

For those considering purchasing property in Tokyo, the used housing market offers a practical alternative. Working with experienced advisors who understand both markets can help identify properties that match your needs and budget.

Housing Japan Perspective

Real estate prices in Tokyo have risen significantly in recent years, particularly in central areas. As a result, we expect growing attention to shift toward the resale market in the coming years.

However, the perception of these price increases differs for overseas buyers. Over the past decade, the exchange rate has moved from a strong yen to a much weaker yen. When viewed in foreign currency terms, Japanese real estate prices have not risen at the same rate as yen-denominated figures suggest.

For international buyers converting dollars, euros, or other currencies into yen, the weaker exchange rate can offset part of the price increase. This means that while property prices may appear to be surging from a domestic perspective, Japanese real estate may not feel as expensive to foreign buyers as headline figures might indicate.

sources: MLIT — Ministry of Land, Infrastructure, Transport and Tourism

Q&As

Why are new condominium prices so high in Tokyo?

New condominium prices have risen primarily due to limited land availability in central areas and strong demand from both domestic and international buyers. Competition for prime development sites has intensified as residential projects compete with office, hotel, and mixed-use developments. In central Tokyo, new units now average over 100 million yen.

Is it a good time to buy used housing in Tokyo?

The used housing market offers a wider range of options in terms of location and price points compared to the limited new construction currently available. Government policy changes have also made mortgage tax benefits more accessible for used housing purchases. However, buyers should carefully evaluate building age, management quality, and potential renovation needs.

How long will the new condominium shortage last?

Industry forecasts suggest the constrained supply will continue through 2026 and likely beyond. While some increase in new supply is expected, land availability challenges in prime areas are structural issues that will take time to resolve.

What percentage of Tokyo condominium sales are used properties?

Used condominiums now account for approximately 90% of all condominium transactions in the Tokyo metropolitan area. New condominiums represent only about 10% of the market, down from over 20% in previous years.

Housing Japan specializes in buying, selling, and managing luxury real estate in central Tokyo. Housing Japan has 25 years of Real Estate experience and multilingual staff that will skillfully guide you through the entire process. Whether you are exploring new or used properties, or considering property development opportunities, our team can help guide you through the process and find options that match your requirements.

Contact Us

Housing Japan

7F BPR Place Kamiyacho, 1-11-9 Azabudai, Minato-ku, Tokyo, Japan 106-0041