Japan’s tourism industry has achieved remarkable success in 2024, shattering records and positioning the country as a premier global destination. With visitor numbers soaring to unprecedented heights and Chinese travelers selecting Japan as their top international destination during the Lunar New Year holiday, the tourism surge has become a significant driver of Japan’s economic recovery.

Record-Breaking Tourism Numbers

Approximately 36.87 million international tourists visited Japan in 2024, the highest number since records began in 1964. This represents a 7% increase compared to pre-pandemic levels, with Japan welcoming over 3 million foreign tourists monthly – a figure that places it as the best-performing market in the Asia-Pacific region in terms of visitor arrivals.

This recovery has been particularly impressive when compared to other markets in the region. While many Asian destinations are still struggling to reach their pre-pandemic numbers, Japan has exceeded its 2019 visitor levels by 10%, significantly outperforming neighboring countries like South Korea (-5%), Indonesia (-8%), and Singapore (-14%).

The surge in tourism has translated into substantial economic benefits. Tourist spending reached ¥8.1395 trillion (approximately $53 billion USD) in 2024, representing a 16% increase from 2019 figures. According to the World Travel & Tourism Council, the economic contribution to Japan’s economy is expected to reach nearly ¥44.6 trillion ($291.5 billion), while creating approximately 6 million jobs—200,000 more than previous peak levels.

China’s New Top Destination

One of the most notable developments has been Japan’s emergence as the number one overseas destination for Chinese travelers during major holiday periods. During the 2025 National Lunar New Year holiday, Japan topped the list of international destinations for Chinese tourists, overtaking Thailand which had historically been a favored destination.

This shift can be attributed to several factors which include Airfare reductions which has seen flights between China and Japan reducing by 30% compared to with previous years making travel more affordable than ever; Strong cultural appeal as Chinese travels are increasingly drawn to Japan’s food, culture and shopping opportunities; Evolving tourist behavior shows as Chinese travels are seeking more experiential travel rather than primarily shopping-focused visits and accessibility as Japan’s proximity and increasing flight connections make it a convenient international destination.

Despite these positive developments, Chinese tourism to Japan has not fully recovered to pre-pandemic levels, with visitor numbers in August 2024 reaching approximately 740,000—about 74% of August 2019 figures. However, this demographic continues to contribute significantly to tourism spending, accounting for 21% of total tourist expenditure in Q2 2024.

Diversification of Visitor Sources

While China remains an important market, Japan has successfully diversified its tourism base. South Korea has emerged as the largest contributor of visitors, accounting for 24% of all tourist arrivals in early 2024. This surge followed the warming of Japan-South Korea relations in 2023, when leaders from both countries met to resolve trade disputes and historical disagreements.

Taiwan and Hong Kong have also become increasingly important markets, with visitors from these regions increasing by 19% and 15% respectively in the first five months of 2024 compared to the same period in 2019. They now make up around a quarter of total visitor arrivals.

American tourism has seen remarkable growth as well, with U.S. visitor numbers up 60.1% compared to 2019. Japan has become the top Asian destination for American travelers, surpassing traditional favorites.

This diversification has provided Japan with greater resilience against geopolitical tensions or economic downturns in any single market. As of Q2 2024, non-Chinese tourist numbers were 6% higher than the total number of tourists visiting Japan in Q4 2019, with their expenditure 40% higher than average pre-pandemic levels.

Economic Impact and Currency Advantages

The weak yen has been a significant driver behind Japan’s tourism recovery. Since December 2019, the yen has depreciated 44% against the US dollar and 26% in nominal effective exchange rate terms, making Japan an exceptionally affordable destination for international travelers.

This favorable exchange rate has transformed Japan’s international competitiveness in the tourism sector. For example, the price of a Big Mac in Japan (¥480 or $3.19) is nearly 80% less than in the United States ($5.66 or ¥856), illustrating the substantial purchasing power advantage foreign tourists currently enjoy.

Tourism has grown to become a critical component of Japan’s export earnings, overtaking semiconductors and steel to become Japan’s second-largest export category behind only automobiles. This represents a fundamental shift in Japan’s economic structure, with tourism emerging as a pillar of growth in Prime Minister Fumio Kishida’s economic strategy.

Investment opportunities

The tourism surge energizes both short-stay and extended-stay rental markets, which can lead to strong returns. The low yen creates a golden opportunity for international real estate investors, offering better property prices in Japan. This currency advantage, combined with record-breaking tourism numbers particularly around Tokyo, makes investment timing ideal. Additionally, expats benefit doubly – enjoying increased purchasing power for property acquisition while their foreign-currency income stretches further in daily life, creating a favorable environment for both living and investing in Japan.

What to make the most this opportunity, Invest in property with Housing Japan now!

Regional Tourism Distribution

Despite record visitor numbers, Japan faces the challenge of tourist concentration in major urban areas. Tokyo, Osaka, and Kyoto remain the primary magnets for international visitors, with these destinations experiencing significant year-over-year growth. Tokyo saw a 42% increase in local and foreign tourists in early 2024 compared to the same period in 2019, while Osaka experienced 16% growth.

By prefecture, the inbound tourist visit rate in 2023 was highest in Tokyo at 48.6%, followed by Osaka (43.5%), Chiba (36.1%), Kyoto (33.7%), and Fukuoka (13.4%). Every other destination in Japan recorded visit rates in single figures.

The Japanese government has recognized this imbalance and implemented initiatives to distribute tourism benefits more evenly across the country. These include: Adventure tourism development, where Japan is promoting adventure travel experiences in less-visited regions, particularly through partnerships with the Adventure Travel Trade Association; Gastronomy tourism, where Japan Tourism Agency launched financial subsidies for developing and promoting programs focusing on regional culinary cultures and building new Luxury resort development which is a pilot project that is underway to attract high-end hotels in four national parks, with plans to establish at least one luxury resort hotel in each of the country’s 35 national parks by fiscal 2031.

What Attracts Visitors to Japan?

According to 2023 surveys, Japanese food ranked as visitors’ primary reason for choosing Japan as a destination, followed by nature/scenery sightseeing, hot springs, and shopping. However, preferences vary significantly by region of origin.

For Asian visitors, shopping remains a major draw, while cultural activities and experiences tend to be more important for Western tourists. This diversity of attractions has helped Japan appeal to a broad international audience.

Japan’s competitiveness extends beyond price advantages. The country ranked third in the World Economic Forum’s travel and tourism development index, after the United States and Spain. It scores particularly well in cultural resources, ground infrastructure, and natural attractions.

Are you also looking to come to japan? see some great short term stay options in tokyo at KensPlace

Looking Ahead: Sustainability and Growth

The Japanese government has ambitious plans for further tourism expansion, targeting 60 million annual visitors by 2030. This goal represents a 2.4-fold increase from current levels, with expected tourist spending to reach ¥15 trillion (approximately $98 billion).

To achieve sustainable growth, Japan is implementing various strategies:

- Preventing overtourism: Cities like Kyoto have implemented measures to manage tourism flows, including restricting access to certain areas, improving public transportation, and creating “hands-free” luggage services.

- Managing natural resources: Mount Fuji implemented entry gates limiting climbers to 4,000 daily and introduced a climbing fee of ¥2,000 per person to protect the iconic peak.

- Infrastructure improvements: Enhanced transportation networks, including expanded capacity at airports like Haneda, which handled 32.2% more international flights than in 2019.

- Extending visitor seasons: Promoting travel during traditionally quieter periods to reduce seasonal concentration.

The Future Outlook

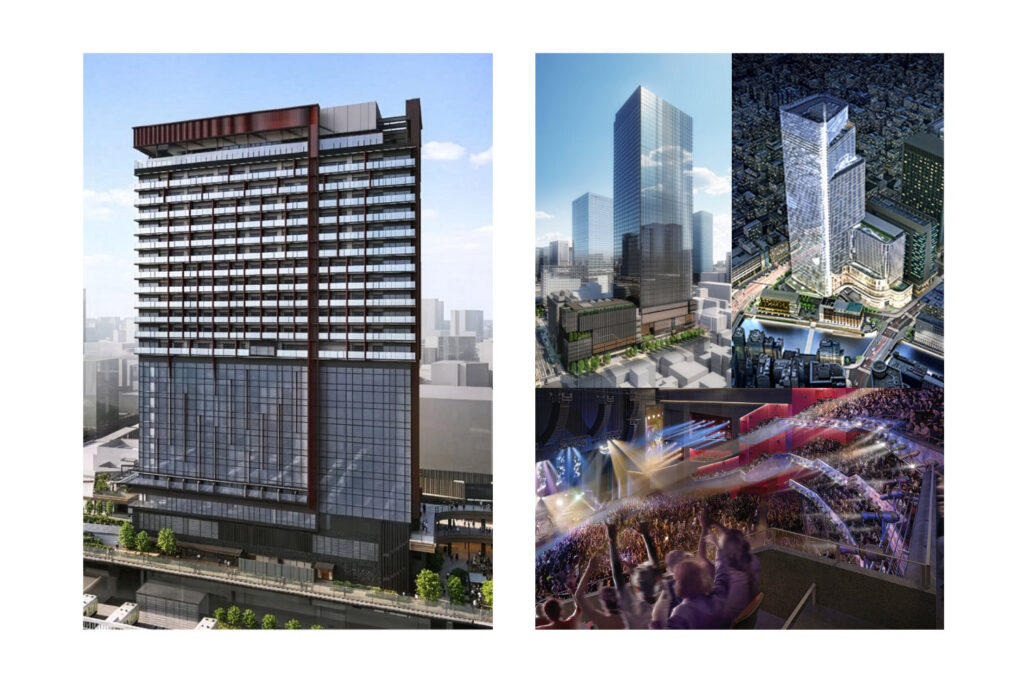

With the upcoming World Expo in Osaka in 2025 and the construction of Japan’s first integrated resort casino expected to be completed by 2030, Japan continues to develop new attractions to sustain tourism momentum.

The tourism industry has demonstrated remarkable resilience and adaptability in the post-pandemic era. While challenges remain in managing growth and ensuring benefits reach all regions of the country, Japan’s tourism boom represents a vital economic opportunity for a nation facing demographic challenges and seeking new growth drivers.

As Japan continues to balance economic opportunity with sustainability concerns, its success in tourism diversification provides valuable lessons for destinations worldwide seeking to build resilient and competitive visitor economies.

Q&A

How many tourists visited Japan in 2024?

Approximately 36.87 million international tourists visited Japan in 2024, the highest number since records began in 1964, exceeding pre-pandemic levels by about 7%.

What is the economic impact of tourism in Japan?

Tourism contributed nearly ¥44.6 trillion ($291.5 billion) to Japan’s economy in 2024 and supported around 6 million jobs. Visitor spending reached ¥8.1395 trillion ($53 billion), a 16% increase from 2019.

Which country sends the most tourists to Japan?

South Korea is currently the largest source market, accounting for about 24% of all tourist arrivals in 2024, followed by China (18%), and Taiwan (15%).

What is Japan’s target for future tourism growth?

The Japanese government is targeting 60 million annual visitors by 2030, with expected tourist spending to reach ¥15 trillion (approximately $98 billion).

What Next?

Whether you’re embarking on your journey to Japan or settling into the vibrant heart of Tokyo, Housing Japan is your ultimate destination. We specialise in buying, selling, and managing residential luxury real estate in central Tokyo. From short-term accommodations to extended stays of 30 days or more, we offer a wide range of options in convenient locales. Whether you are a local resident or simply seeking a second home or temporary residence for business trips, we have you covered. Our one-stop service includes expert management services, so you can sit back and relax knowing that everything is taken care of. Whether you are looking for a luxurious living experience or an investment opportunity, we are here to help you every step of the way.

Sources:

https://www.mlit.go.jp/kankocho/content/001767069.pdf

https://mainichi.jp/english/articles/20241001/p2a/00m/0bu/009000c

https://ceias.eu/whats-behind-japans-post-pandemic-tourism-surge/