Japan’s healthcare system is known worldwide for being both affordable and high-quality. For people living in Japan, understanding how health insurance works is important for getting medical care when you need it. This guide explains everything you need to know about Japan’s health insurance system, from the basic requirements to costs and coverage options.

Why Health Insurance Matters in Japan

Japan has what’s called universal healthcare. This means everyone living in the country for three months or more must have health insurance, it’s not optional. The good news is that this system keeps medical costs low while making sure you can get good care when you need it. Without insurance, medical bills can be very expensive, but with proper coverage, you’ll only pay a portion of the total cost.

The government controls medical prices across the country, so a doctor’s visit costs the same whether you’re in Tokyo or a small rural town. This makes healthcare predictable and affordable for everyone.

The Two Main Types of Health Insurance

Japan offers two main health insurance programs for residents. Which one you use depends on your job situation.

Japan Employee Health Insurance (Kenko Hoken 健康保険)

Employee Health Insurance is for people who work full-time for Japanese companies. If you have a regular job, your employer will sign you up for this insurance automatically. You don’t need to do anything, the company’s HR department handles all the paperwork. This insurance covers 70% of your medical bills, and you pay the remaining 30%. The monthly cost is taken directly from your paycheck, and your employer pays half of the total premium.

This can make it cheaper than paying for insurance on your own. The amount you pay depends on how much money you make. For example, if you earn about 350,000 yen per month, you might pay around 17,500 yen for insurance, while your company pays another 17,500 yen. The insurance also covers your family members if you add them to your plan.

Japan National Health Insurance (Kokumin Kenko Hoken 国民健康保険)

National Health Insurance is for everyone else, students, self-employed people, freelancers, part-time workers, and retirees. If you don’t have Employee Health Insurance, you must sign up for this program. You register for National Health Insurance at your local city or ward office when you register your address in Japan. The staff will help you fill out the forms and give you an insurance card that you’ll need for all medical visits.

Like Employee Health Insurance, this program covers 70% of medical costs, and you pay 30%. The monthly premium is based on your income from the previous year and your family size. If you just arrived in Japan, you’ll likely pay the minimum amount until the next tax year begins. The bills come once a year, usually in April or May. You get nine separate payment slips for July through March (no payments needed from April to June). You can pay these bills at any convenience store, making it very easy to stay current.

Long Life Medical Care System

People who are 75 or older, or those over 65 with certain disabilities, use a special program called the Long Life Medical Care System. This program can cover up to 90% of medical costs for people with low incomes, though most people still get the standard 70% coverage.

What Health Insurance Covers

Both major insurance programs cover most medical care you might need. This includes regular doctor visits, emergency care, hospital stays, surgeries, and prescription medications. The insurance works at any clinic or hospital that accepts the national system, which is almost everywhere. When you visit a doctor, you show your insurance card and pay your 30% share right away. There’s no need to file claims or wait for reimbursement like in some other countries. Japan also has monthly caps on how much you can pay, so if you have expensive medical treatment, you won’t face unlimited costs. When you sign up for insurance, you’ll get a booklet explaining these limits.

For women who become pregnant, the insurance includes prenatal checkup vouchers and a lump sum payment of 500,000 yen to help with delivery costs. This amount was increased from 420,000 yen in April 2023 to better match current childbirth expenses. While this might not cover everything, it significantly reduces the expense of having a baby.

Costs and Payment Examples

The cost of health insurance varies based on your income and which program you’re in. Employee Health Insurance is usually cheaper because your employer shares the cost. For National Health Insurance, people earning around 4 million yen per year might pay approximately 250,000 yen annually, which works out to about 28,000 yen per month if on the Kokumin Kenko Hoken.

These costs might seem high, but remember that you’re getting comprehensive coverage that includes everything from routine checkups to major surgeries. The government’s price controls mean you won’t face surprise medical bills.

Private Health Insurance Options

While Japan’s national system covers most medical needs, some people choose to add private insurance for extra coverage or convenience. Private insurance can help with costs that national insurance doesn’t cover completely, like certain dental procedures, cosmetic treatments, or private hospital rooms. Some private plans also offer coverage for alternative treatments or provide faster access to specialists. International residents sometimes prefer private insurance that includes services in English or coverage for medical treatment in their home countries. These plans typically cost more than national insurance but can provide peace of mind for people who want additional options.

It is also worth noting that some hospitals and medical establishments don’t accept private health insurance meaning you would have to pay the total fee up front and then claim it back through the insurance company.

Tourist and Short-Term Visitor Insurance

Tourists and people staying in Japan for less than three months can’t join the national insurance programs. Instead, they need travel insurance or short-term medical insurance. Several companies offer insurance specifically for visitors to Japan. These plans typically cover 100% of medical costs up to certain limits. This can be helpful since visitors would otherwise pay full price for medical care. If you’re planning to stay longer than a few months, you should look into getting a residence visa so you can join one of the national insurance programs, which can be much more affordable for long-term stays.

Important Update: Japan is currently planning to make health insurance mandatory for all incoming tourists, similar to requirements in other countries. This change is being developed to address unpaid medical bills from visitors and is expected to be implemented in the near future.

Tips for Using Health Insurance in Japan

Always keep your insurance card with you, you’ll need it for every medical visit. If you forget it, you might have to pay the full cost upfront and get reimbursed later. Some doctors speak at least some English, and many clinics have translation sheets to help you describe symptoms. If you need more comprehensive English support, there are clinics that specialize in serving international patients.

Remember that some services aren’t covered by insurance, including most vaccinations, some dental work like crowns, and cosmetic procedures. Ask about costs before getting these treatments.

Finding Your New Home with Housing Japan

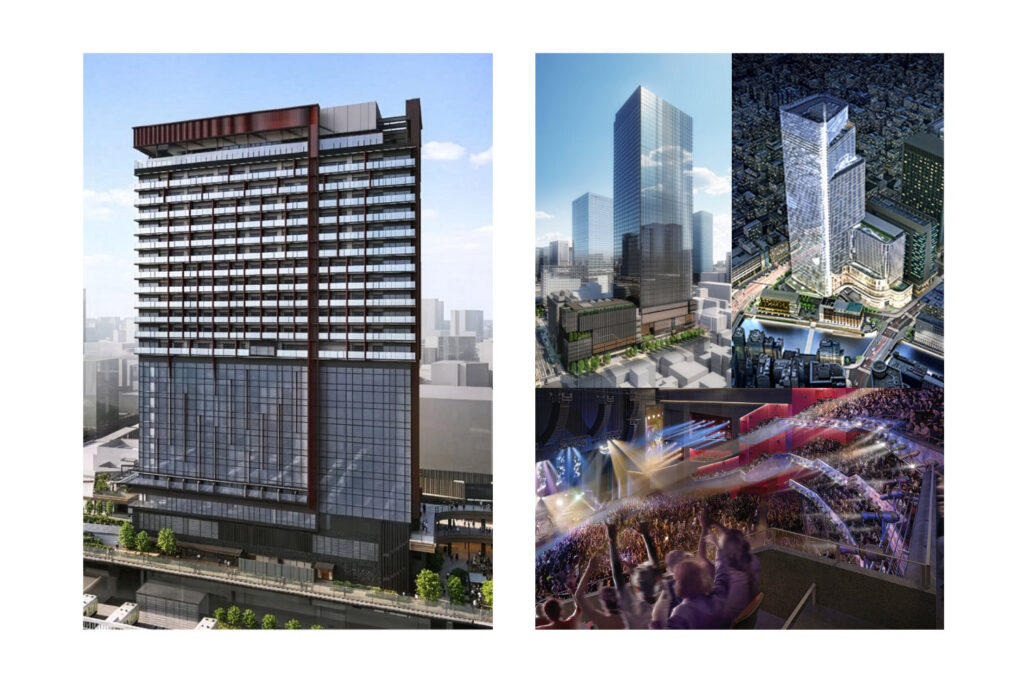

If you’re planning to move to Japan and need to find the perfect property, Housing Japan can help ensure a smooth transition. As a luxury real estate company specializing in Tokyo’s best neighborhoods, Housing Japan understands the unique needs of international residents.

Their team, with 25 years of experience, can guide you through Tokyo’s property market, from understanding requirements to finding homes in areas with good access to international schools and English-speaking medical facilities. Whether you’re looking for a temporary residence while you settle in or a long-term investment property, Housing Japan’s personalized service ensures you find the right home for your new life in Japan.

Conclusion

Japan’s health insurance system provides excellent coverage at reasonable costs, making it one of the world’s best healthcare systems. Whether you’re employed or self-employed, student or retiree, there’s a program designed to meet your needs.

Understanding how the system works and choosing the right coverage will help you access quality medical care while living in Japan. The universal coverage means you can focus on enjoying your time in Japan without worrying about unexpected medical expenses.

Q&A: Health Insurance in Japan

Is health insurance mandatory for foreigners living in Japan? Yes, all foreign residents staying in Japan for three months or longer must have health insurance by law. You’ll enroll in either Employee Health Insurance through your job or National Health Insurance at your local city office. This requirement applies to all visa types including work, student, and spouse visas. Tourists do not have to have health insurance, but it is recommended.

How much does National Health Insurance cost in Japan? National Health Insurance costs vary based on your previous year’s income and family size. Most people pay between 20,000-40,000 yen monthly. New residents often pay minimum rates initially with the maximum premiums reaching 900,000 yen/year in Tokyo for high earners.

What percentage of medical costs does Japanese health insurance cover? Japanese health insurance covers 70% of most medical expenses, including doctor visits, hospital stays, surgeries, and prescriptions. You pay the remaining 30% at the time of service. Monthly payment caps protect you from excessive costs during expensive treatments or extended hospital stays.

Can I use Japanese health insurance at any hospital or clinic? You can use your insurance card at virtually any clinic or hospital in Japan that accepts the national system, which includes almost all medical facilities. No referrals are typically required, though some hospitals charge slightly higher fees for direct visits without referrals from family doctors.

What happens if I don’t pay my health insurance premiums in Japan? Unpaid health insurance can result in losing coverage, being required to pay back premiums for missed months or years and facing penalties. Your insurance card may be suspended, forcing you to pay full medical costs upfront. Local authorities actively track insurance payments and will contact you about overdue bills.

Important Disclaimer

This article provides general information about Japan’s health insurance system and should not be considered professional advice. Health insurance rules, costs, and coverage can change, and individual situations may vary. We strongly recommend consulting with your local ward office, employer’s HR department, or a qualified insurance professional for advice specific to your situation.

Always verify current requirements and costs with official sources before making insurance decisions. See information on health insurance from The Ministry of Health, Labour and Welfare in Japan -> Here